capital gains tax changes 2022

Will Capital Gains Increase In 2022. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

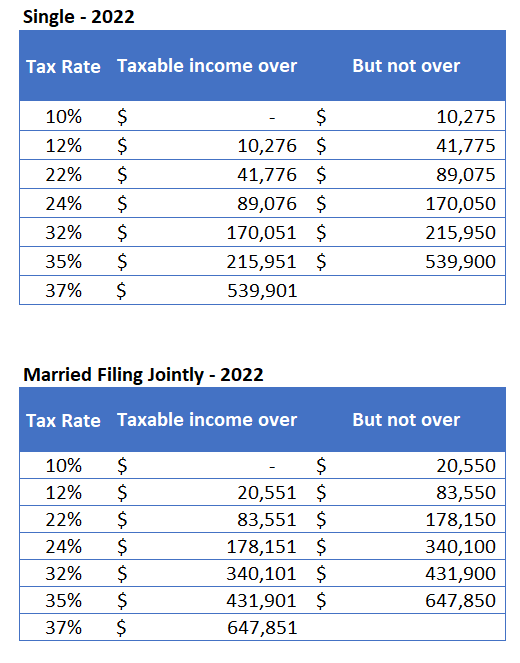

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

4 rows SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those.

. The higher rate will take effect at 400000 for single filers 450000 for married filing jointly. There is a change on the horizon which can take place as soon as 2022. This may allow you to pay less tax on the income.

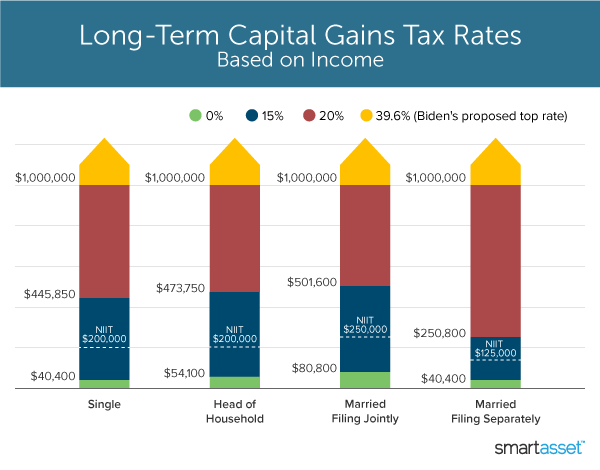

If they earn between 40401 and 445850 they are subject to. Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes in 2022. This is a lower income level than the 20 rate takes effect now.

Capital Gains Tax. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. Capital gains on personal investments tend to be 15 percent as the tax rate applies to incomes up to 459750 for single taxpayers.

Tax on income from virtual assets a perpetual amnesty scheme of sorts for unreported income cap on the surcharge on long term capital gains end date for concessional rate of tax on dividend received from foreign companies and timeline extension for manufacturing companies are among the key direct tax changes introduced in Budget 2022. A single taxpayer filing his or her taxes can benefit from the zero percent capital gains rate as long as he or she is below 41675 in 2027. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. A new top long-term capital gains rate of 25 will replace the current 20 rate.

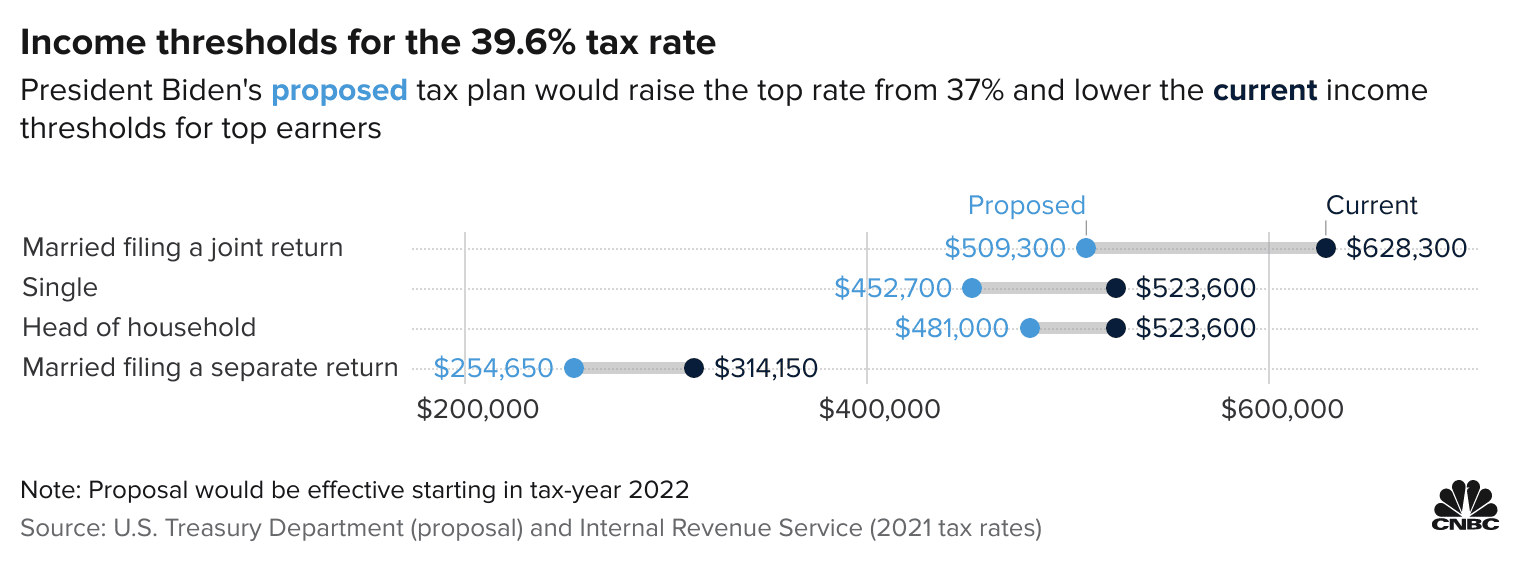

Nonetheless many sellers are looking to secure a sale before 2022 because of the possibility that any sale following 2022. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022. President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40.

For example if a taxpayer made 900000 from their salary and 200000 from LTCGs then 100000 of the LTCG would be taxed at the favorable 20 rate while the. Will Capital Gains Taxes Go Up In 2022. Ordinary income brackets begin at.

March 8 2022 by Brian A. Historically capital gains tax has sat around 20. Heres how it works and how to avoid a big tax bill.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Zero percent capital gains will be available to single tax filers earning less than 41675 in 2022. Long Term Capital Gains Rate 2022 Ca Capital Gains Tax Rate 2022 It is commonly accepted that capital gains are gains made through the sale an asset such as stocks or real estate or a corporation and that these profits constitute taxable income.

As 2021 draws to a close many commercial real estate investors are looking to sell. Tax increases in 2022 If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases are likely to take effect. Currently the capital gains tax rate for wealthy investors sits at 20.

Capital gain tax changes. Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income is more than 1 million. Most single people with investments will fall into the 15 capital gains rate which applies to incomes between 41675 and 459750.

Capital gains tax rates for tax years 2022 For example in 2021 individual filers who earn under 40000 without deducting business expenses will not have to pay capital gains tax. As of now the tax law changes are uncertain. The proposal is bumping this up to 396.

When people invest in a vehicle they are generally subject to the 15 capital gains rate which applies to incomes between 41675 and 455825. There are exceptions to this such as when it was 15 from 2004 to 2012. 4 rows Although the capital gains tax rates for long-term investments which are those youve held.

The five changes for 2022 that you need to know about AS MILLIONS of Britons make the most of the new year to get on top of their finances people are being reminded of some big. One large reason for the influx in property sales is the projected increase in capital gains taxes for 2022. Avoid Capital Gains Tax on Real Estate in 2022 The money you make on the sale of your home might be taxable.

What You Need To Know About Capital Gains Tax

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

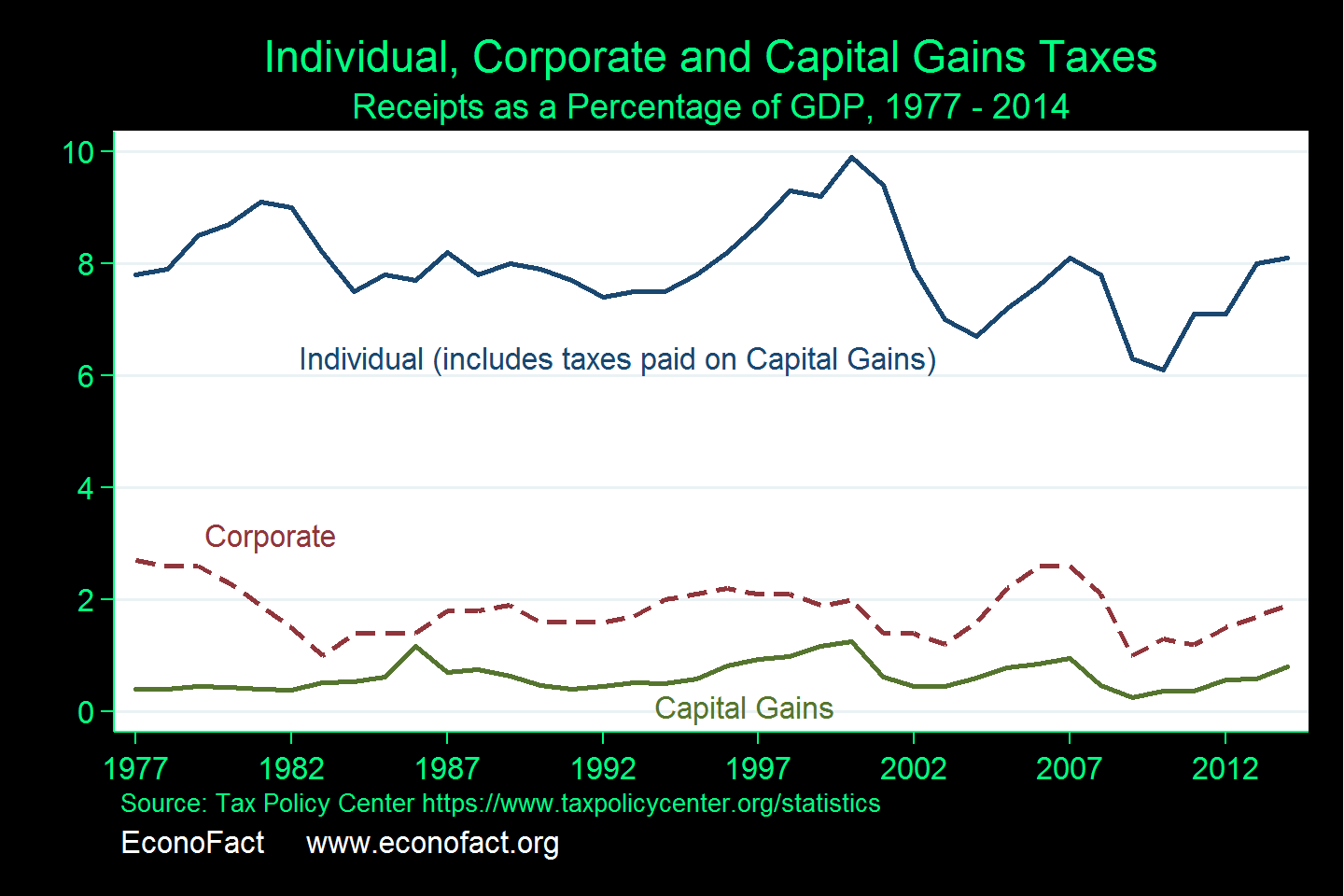

The Capital Gains Tax And Inflation Econofact

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

What You Need To Know About Capital Gains Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)